In New York City, taxes can be confusing. A Tax Calculator NYC makes it easier to understand what you owe. Whether you’re a resident, business owner, or property investor, this tool helps you estimate your taxes quickly.

By entering basic details like your income, filing status, and deductions, you can get a clear estimate of your tax obligations. This includes income tax, sales tax, and property tax. It’s a fast and simple way to avoid surprises and stay on top of your finances.

Using a tax calculator can also help with future planning. It shows you where your money is going and helps you avoid underpaying or overpaying. This tool is useful during tax season or anytime you want to check your financial situation.

If you want to stay organized and stress-free, a Tax Calculator NYC is a must-have. It’s quick, easy, and helps you take control of your money.

Overview of New York City Tax System

Understanding New York City’s tax system is crucial for residents, businesses, and property owners. It impacts your finances in many ways, so knowing the key taxes helps you plan better.

Income Tax

- NYC has a progressive income tax system with rates ranging from 3.078% to 3.876%, depending on your income.

- Both residents and non-residents working in the city may be subject to this tax.

Sales Tax

- The total sales tax rate in NYC is 8.875%, combining state, city, and metropolitan commuter taxes.

- This tax applies to most goods and services, which adds to everyday expenses.

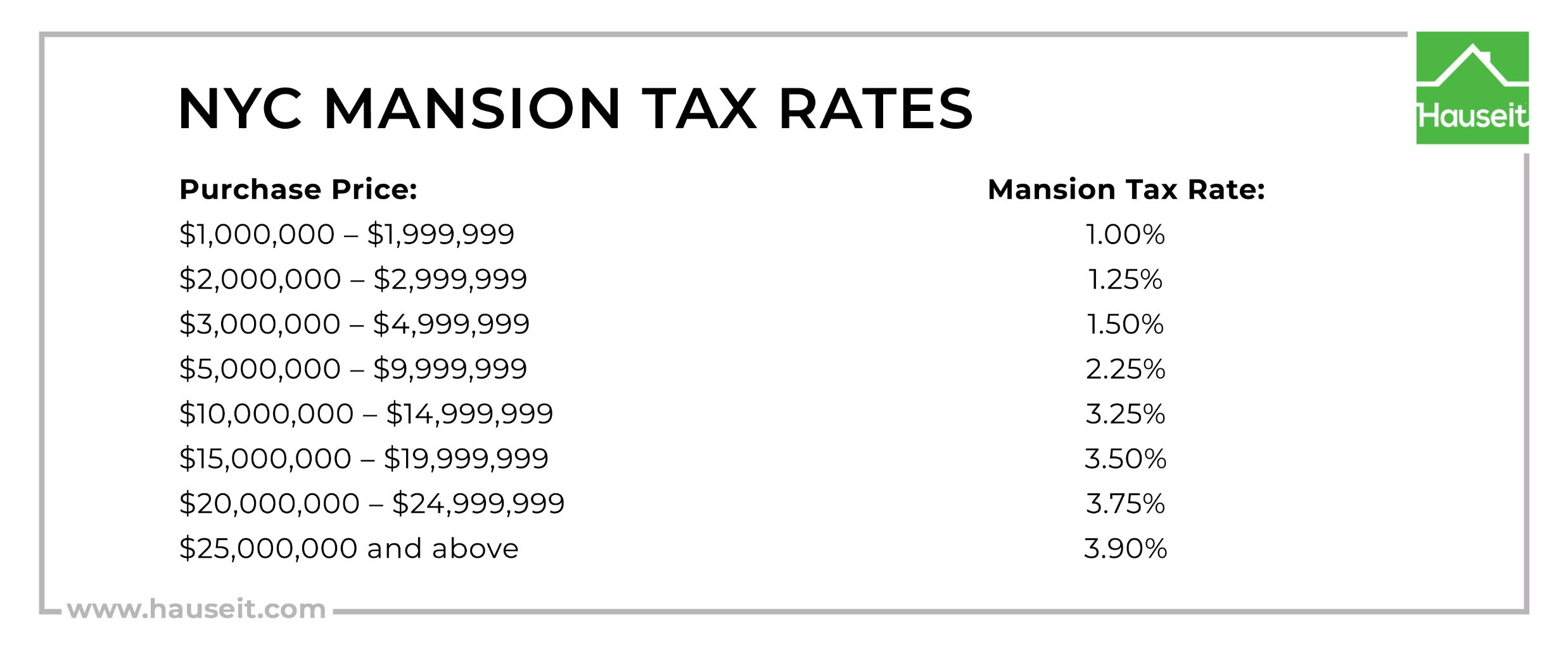

Property Tax

- Property tax is based on your real estate’s value and is assessed annually.

- It’s a major expense for homeowners and property investors in the city.

By using a Tax Calculator NYC, you can estimate your obligations and plan your finances more accurately.

Types of Taxes in New York City

Living or working in New York City means dealing with various taxes. Each tax has specific rules and rates, so understanding them helps you manage your finances better.

Income Tax

- NYC uses a progressive income tax system, with rates ranging from 3.078% to 3.876% based on your earnings.

- Both residents and non-residents working in the city must pay this tax.

Sales Tax

- The sales tax rate is 8.875%, applying to most goods and services purchased within the city.

- This tax combines state, city, and metropolitan commuter taxes.

Property Tax

- Property owners pay tax based on the assessed value of their real estate.

- Rates vary depending on property classification and location.

Other NYC Taxes

- Unincorporated Business Tax (UBT): Applies to self-employed individuals and unincorporated businesses.

- Hotel Occupancy Tax: Charged on hotel stays, with rates depending on the room price.

Using a Tax Calculator NYC simplifies these complex taxes by giving you quick, accurate estimates based on your financial details.

How a Tax Calculator for NYC Works

A tax calculator for NYC makes tax calculations simple and quick. It helps you understand your taxes without doing the hard math yourself.

First, you enter your personal details. This includes your income, filing status, and any deductions. If you own property, you may also add its value.

Next, the calculator applies the correct tax rates. For income tax, it uses rates from 3.078% to 3.876%. It also considers both city and state taxes automatically.

Finally, it calculates your estimated tax amount. You’ll see a breakdown for income, sales, and property tax.

This tool saves time and reduces mistakes. It also helps you avoid paying too much or too little. Whether planning ahead or filing, it keeps things simple.

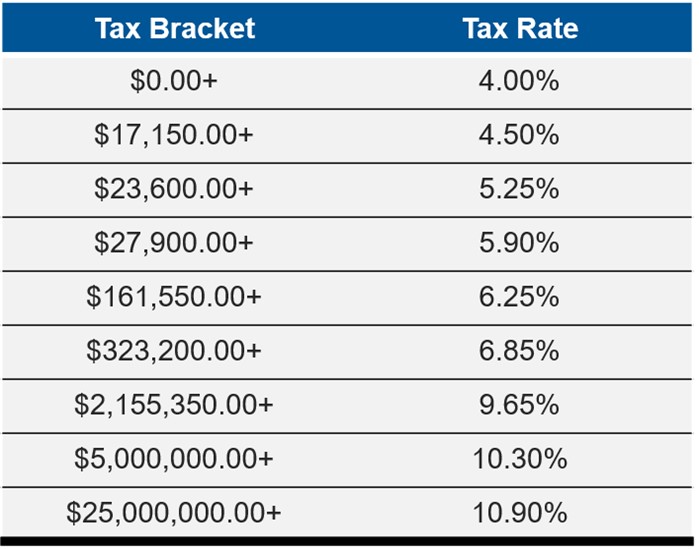

Income Tax Rates in NYC

In New York City, income tax rates increase as your income rises. Knowing these rates helps you plan and avoid surprises when filing your taxes.

If you earn up to $21,400, the tax rate is 3.078%. For income between $21,400 and $45,000, the rate is 3.762%. Those earning between $45,000 and $90,000 pay 3.819%. If you earn over $90,000, the rate is 3.876%.

These rates apply to single filers. If you’re married or filing as head of household, the rates may differ slightly.

Besides income tax, there are other city taxes like the Metropolitan Commuter Transportation Mobility Tax (MCTMT).

A Tax Calculator NYC helps you estimate your taxes accurately. It also considers deductions and credits, making tax planning easier for you.

Sales Tax in New York City

In New York City, sales tax is 8.875%, making it one of the highest in the country. This total rate includes 4% state tax, 4.5% city tax, and 0.375% for the Metropolitan Commuter Transportation District.

You pay this tax on most goods and services. It applies to retail sales, restaurant meals, and hotel stays. However, some items are exempt. For example, clothing under $110, groceries, and certain medical supplies are not taxed.

To calculate the sales tax, multiply your purchase by 0.08875. This gives you an estimate of how much you will pay.

Using a Tax Calculator NYC can make this process easier. It helps you track taxes on purchases and plan your budget more accurately.

How to Use the NYC Tax Calculator for Accurate Calculations

The NYC Tax Calculator is a simple tool that helps you estimate taxes accurately. By following a few steps, you can get a clear picture of your financial obligations.

Input Personal Information

- Start by entering your income details, including salary, investments, and extra earnings.

- Ensure all sources of income are included for precise results.

Select Filing Status

- Choose your filing status—single, married, or head of household—to get accurate calculations.

- This step customizes the estimate based on your situation.

Add Deductions and Exemptions

- Enter any deductions like student loans or charitable donations.

- This helps lower your estimated tax liability.

Review and Plan

- The calculator shows income, sales, and property tax estimates.

- Regular use helps you stay organized and avoid tax surprises.

Deductions and Exemptions in NYC Taxes

Understanding deductions and exemptions in NYC can help lower your tax bill. By claiming these, you reduce your taxable income and overall liability.

Common Deductions You Can Claim

- Standard Deduction: Lowers your taxable income by a fixed amount, which may change yearly.

- Itemized Deductions: Includes medical expenses, mortgage interest, and charitable donations.

- Dependent Exemption: Allows parents or guardians to reduce income by claiming dependents.

- Property Tax Deduction: Homeowners may deduct a portion of their property taxes.

Special Deductions for the Self-Employed

- Business-related expenses like office supplies, travel costs, and professional services are deductible.

- Self-employed individuals must also estimate and pay quarterly taxes to avoid year-end surprises.

Using the NYC Tax Calculator ensures you capture all deductions, leading to accurate calculations and potential savings.

Frequent Errors in Tax Calculations and How to Avoid Them

Mistakes in tax calculations can lead to incorrect estimates and unexpected bills. Using the NYC Tax Calculator carefully can prevent these errors and ensure accuracy.

1. Incorrect Income Reporting

- Always include all income sources, such as wages, freelance work, and investments.

- Missing any income can result in underestimating your total tax liability.

2. Forgetting Eligible Deductions

- Input deductions like mortgage interest, medical expenses, and charitable donations.

- Skipping these reduces potential tax savings and inflates your estimate.

3. Selecting the Wrong Filing Status

- Choose the correct status: single, married, or head of household.

- Filing under the wrong category can change your tax rate significantly.

4. Ignoring State and Local Taxes

- NYC residents owe both city and state taxes.

- Ensure these are included for a complete and accurate calculation.

By carefully entering your details and double-checking your work, you’ll get precise estimates and avoid tax season surprises.

Frequently Asked Questions about NYC Tax Calculator

How much is $100,000 NYC salary after taxes?

- After taxes, a $100,000 salary in NYC is approximately $70,000 to $73,000. This estimate includes federal, state, and city taxes.

How much tax is taken out in NYC?

- In NYC, taxes include federal income tax, state tax, city tax, Social Security, and Medicare, which together can take 30% to 40% of your salary.

How much is $70,000 after taxes in NYC?

- If you earn $70,000 in NYC, you’ll take home approximately $50,000 to $53,000 after deducting all taxes.

What are NYC income tax rates?

- NYC has progressive income tax rates ranging from 3.078% to 3.876%, depending on your income bracket.

What taxes are included in the NYC Tax Calculator?

- The NYC Tax Calculator includes federal, state, city, Social Security, Medicare, and local taxes, including the Metropolitan Commuter Tax (MCTMT).

Can the calculator help me estimate quarterly tax payments?

- Yes, the calculator can estimate quarterly tax payments for self-employed individuals, helping you avoid underpayment penalties.

Can I use the NYC Tax Calculator for property tax calculations?

- Yes, the NYC Tax Calculator can estimate property taxes based on your home’s assessed value and property classification.

Conclusion on Using Tax Calculator Nyc

Using the NYC Tax Calculator makes managing your taxes much easier. It helps you estimate taxes accurately and understand how much you owe. This tool works for individuals, businesses, and self-employed people.

By entering your income, deductions, and expenses, you get a clear picture of your tax obligations. Plus, it reduces errors and helps you avoid underpaying or overpaying taxes.

Regularly using the calculator keeps you prepared for tax season. It also helps you manage quarterly payments and plan your finances better.

With the NYC Tax Calculator, you take control of your taxes. It gives you confidence, reduces stress, and ensures you stay compliant with NYC tax laws all year long.