A take home income calculator helps you find out how much money you actually bring home after taxes and deductions. It’s an easy way to understand your real paycheck amount. This tool is useful if you want to estimate your earnings or plan your budget.

You can also use it to help with steps 3 and 4 of the W-4 form. This is helpful when adjusting your tax withholdings. The calculator is made for U.S. residents and follows the 2025 tax brackets. It also reflects the updated W-4 form, which changed in 2020 for the first time since 1987.

By entering your salary and deductions, you can get a clear picture of your actual earnings. This helps you avoid surprises on payday and makes financial planning easier. Whether you’re an employee or self-employed, this tool gives you accurate and fast results.

What Is a Take Home Income Calculator?

A take home income calculator shows you how much money you actually receive after taxes and deductions. It helps you understand your real paycheck amount, not just your total salary. This tool is useful for planning your budget and managing expenses.

Unlike a gross income calculator, which shows your total earnings before deductions, this calculator focuses on your net income. It considers taxes, insurance, and other withholdings to give you a clear picture.

Using this tool helps you avoid surprises and plan your finances better. It’s a simple way to know exactly how much money you will bring home.

Understanding Different Components of Salary

- Basic Salary

Basic salary makes up 40-50% of your CTC and serves as the foundation for other additions and deductions. It’s the fixed portion you receive monthly. - Special Allowance

This covers expenses like food, internet, and books. However, it’s fully taxable, and the amount varies depending on your company’s policy. - House Rent Allowance (HRA)

If you live in a rented home, HRA helps cover rental costs. Without rent, this amount becomes fully taxable for the employee. - Leave Travel Allowance (LTA)

LTA reimburses your travel expenses during leave. It covers costs for train, bus, or air travel but applies only to domestic trips. - Bonus

Bonus is an extra payment based on performance. It’s fully taxable and is usually paid annually as a reward for your contribution.

Gross Salary Vs CTC

Many people think gross salary and CTC are the same. But, they are different. Gross salary is the total pay before deducting taxes. It excludes provident fund (PF) and gratuity.

On the other hand, CTC stands for Cost to Company. It is the total amount a company spends on you. It includes your basic pay, bonuses, PF, and other benefits.

Your gross salary is what you earn before tax cuts. But, CTC covers everything the company invests in you. Knowing this difference helps you understand your real earnings better. Always check both to avoid confusion.

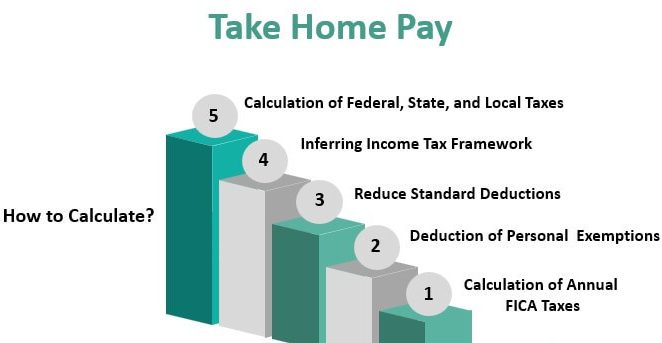

How do salary calculators work?

A salary calculator helps you find your actual take-home pay. It uses your CTC and total deductions to calculate your in-hand salary. The calculator subtracts taxes and other deductions from your CTC.

For example, if your CTC is Rs. 900,000, and your monthly PF is Rs. 2,250, with a professional tax of Rs. 500, these amounts are deducted from your salary.

This means your net take-home pay will be the remaining amount after these cuts. Using a salary calculator makes it easy to understand your real earnings clearly.

Here is the salary breakdown in a clear table format:

| Component | Amount (Rs.) |

|---|---|

| CTC | 9,00,000 |

| Annual PF Contribution (2,250 x 12) | 27,000 |

| Annual Tax (500 x 12) | 6,000 |

| Annual Net Take-Home Salary | 8,67,000 |

| Monthly Net Take-Home Salary | 72,250 |

This calculation shows how your total deductions affect your final in-hand salary.

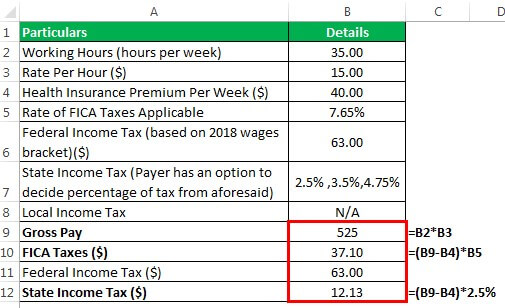

Federal and State Taxes: How They Impact Your Take-Home Pay

Federal income tax uses a progressive system. This means you pay more tax as your income increases. For 2024, tax rates range from 10% to 37%, depending on your earnings.

State taxes also affect your pay. Some states, like California, charge up to 13.3%, while others, like Florida, have no state tax.

Our calculator considers both federal and state taxes. It also includes local taxes if they apply, like in New York City. This ensures you get an accurate estimate of your take-home pay, helping you plan your finances better.

Key Features of the Calculator

- Accurate, real-time calculations

The calculator provides precise, up-to-date calculations by factoring in the latest tax brackets and deduction rules, ensuring you get the most reliable take-home pay estimate. - Supports multiple income types

Whether you earn a salary, work hourly, or freelance, the calculator adjusts to your specific income type, offering a customized and accurate calculation every time. - Customizable deductions for precise results

You can add and adjust deductions like retirement contributions, health insurance, and professional taxes to get a clear picture of your actual take-home pay. - Mobile-friendly interface for easy access

Access the calculator easily from your smartphone or tablet, allowing you to check your net income on the go without hassle or complicated steps.

5. Benefits of Using a Take Home Income Calculator

- Helps with financial planning and budgeting

Knowing your exact take-home pay helps you plan monthly expenses, save for future goals, and manage your budget more effectively. - Provides clarity on your actual earnings

The calculator breaks down your gross pay, deductions, and net income, giving you a clear understanding of what you truly earn after taxes. - Allows for comparison of different job offers

By calculating the take-home pay for multiple offers, you can compare salaries accurately and make better career decisions based on actual earnings.

Common Mistakes to Avoid

- Ignoring tax changes and updates

Tax laws can change yearly, and not staying updated may lead to inaccurate calculations. Always check for new tax brackets or policy changes to stay accurate. - Miscalculating deductions or benefits

Misunderstanding deductions like health insurance, retirement contributions, or bonuses can cause errors. Ensure all deductions are included for a precise take-home pay estimate. - Forgetting state-specific tax rules

Each state has different tax rates, and some even have local taxes. Ignoring these factors can mislead your calculations, especially if you move between states.

Who Should Use This Calculator?

- Employees and freelancers

If you want to know your exact take-home pay after taxes and deductions, this calculator is perfect. It helps you manage your budget and plan expenses accurately. - Job seekers comparing salaries

When evaluating job offers, use the calculator to compare net pay. It reveals how benefits, bonuses, and deductions impact your actual earnings, helping you make better decisions. - Employers offering benefits packages

Employers can use the calculator to estimate net pay for employees. It ensures transparency when discussing salary packages, making it easier to attract and retain top talent.

FAQs

Is the calculator free to use?

Yes, the calculator is completely free to use. You can calculate your take-home pay without any charges or hidden fees.

How accurate are the results?

The results are highly accurate as the calculator uses the latest tax laws and real-time calculations. It considers federal, state, and local taxes for precise estimates.

Can I use it for multiple income sources?

Yes, you can. The calculator supports various income types, including salary, freelance, and hourly wages, allowing you to calculate combined earnings easily.

Does it account for changing tax laws?

Absolutely! The calculator updates regularly to reflect new tax regulations. This ensures you always get the most accurate and up-to-date take-home pay estimates.

How do you calculate your income?

To calculate your income, add all your earnings, including salary, bonuses, and other payments. Then, subtract taxes and deductions to get your net income.

How is income tax calculated in Pakistan?

Income tax in Pakistan is calculated based on progressive tax slabs. Higher earnings attract higher tax rates. The tax amount depends on your annual income and applicable deductions.

How do you calculate net income?

Net income is calculated by subtracting all deductions, including taxes and benefits, from your gross salary. This is the actual amount you take home.

How can I get computation of income?

You can get a computation of income by adding your total earnings and then deducting applicable taxes, benefits, and contributions. Use our calculator for an instant and accurate breakdown.

Conclusion

The take-home income calculator is a must-have tool for you. It gives you a clear picture of your actual earnings after taxes and deductions. This helps you plan your budget better and avoid financial surprises.

By using this tool, you can compare job offers easily and understand how benefits affect your pay. It also keeps you updated with changing tax laws, ensuring accurate results.

With this calculator, you take control of your finances and make smarter decisions about your money. It’s simple, quick, and essential for anyone managing their income.