Income Tax Calculator California: If you live in California and earn $70,000 a year, you may pay around $10,448 in taxes. Your average tax rate is 10.94%, while your marginal tax rate is 22%. This means any extra money you earn will be taxed at 22%.

California’s income tax rates are some of the highest in the U.S., ranging from 1% to 12.3%. Your actual tax depends on your income, filing status, and whether you are 65 or older or blind. If your income is below the 2024-2025 standard deduction, you won’t owe any tax.

Use our Income Tax Calculator California to quickly estimate how much you might pay. It helps you understand your tax responsibility and plan ahead. Whether you’re preparing for tax season or just curious, our tool gives you a fast and accurate estimate.

Understanding your California income taxes

California’s income tax ranges from 1% to 13.3%, making it one of the highest in the country. The state uses a progressive tax system, meaning you pay more as you earn more.

If you file as single, you get a $4,537 standard deduction. Married or joint filers receive a $9,074 deduction. These deductions lower your taxable income, reducing the amount of tax you owe.

California’s tax system is designed to ensure fairness based on your income. Higher earners pay a larger share, while lower earners get relief through deductions.

Understanding these rates and deductions can help you plan better and save money. Use an income tax calculator to quickly estimate how much tax you’ll pay. It’s a simple way to stay on top of your finances.

Calculate your income tax in California

Work out your total federal income tax

- Gross Income Adjusted

Your gross income is the total you earn. Subtract pre-tax deductions, like retirement contributions, to find your adjusted gross income for tax calculations. - Federal Taxable Income

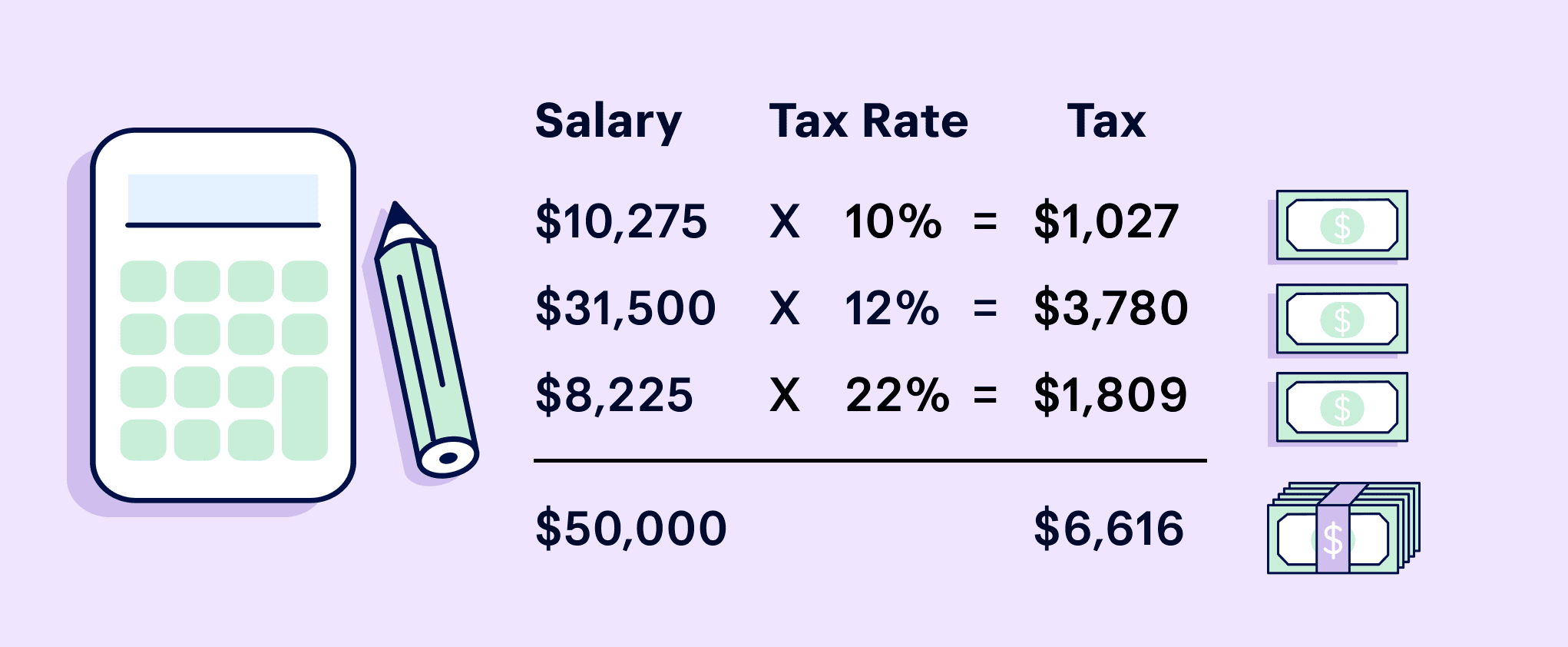

Take your adjusted gross income and subtract the federal standard deduction or itemized deductions. This gives you your taxable income, which determines how much tax you owe. - Federal Income Tax Liability

Multiply your taxable income by the federal income tax rate. This shows your federal income tax before any credits, adjustments, or additional deductions. - Federal Payroll Tax Liability

Calculate this by multiplying your gross income by the federal payroll tax rate. This includes Social Security and Medicare taxes, which are separate from your regular income tax.

Calculate Your Total California State Income Tax

- California State Taxable Income

To find your taxable income, subtract California’s standard or itemized deductions and exemptions from your adjusted gross income. This amount is used to calculate your state tax. - California State Income Tax Liability

Multiply your California state taxable income by the applicable tax rate. This gives you the total amount of state income tax you owe based on your earnings. - California State Payroll Tax Liability

Your payroll tax is calculated by multiplying your gross income by California’s payroll tax rate. This covers additional contributions like disability insurance and unemployment insurance.

Add up all the taxes

To find your total tax liability, add all your taxes together. This includes your federal income tax, federal payroll tax, and California state income tax. Don’t forget to include California’s payroll tax and any local income tax you might owe. Each of these amounts contributes to your final tax bill.

By combining them, you get a clear picture of how much tax you need to pay. Understanding this total helps you plan better and avoid surprises when tax season arrives. Always review your deductions and exemptions to lower your overall tax burden.

California personal income tax rates for 2025

California uses a graduated tax system, so higher earnings mean higher tax rates. For 2025, the state adjusted tax brackets and deductions due to 3.3% inflation. This update affects your filing requirements and available credits, helping you understand how much tax you might owe.

California personal income tax rates for 2025

| Tax Rate | Single & Married Filing Separately | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 1% | $0 to $10,756 | $0 to $21,512 | $0 to $21,527 |

| 2% | $10,756 to $25,499 | $21,512 to $50,998 | $21,527 to $51,000 |

| 4% | $25,499 to $40,245 | $50,998 to $80,490 | $51,000 to $65,744 |

| 6% | $40,245 to $55,866 | $80,490 to $111,732 | $65,744 to $81,364 |

| 8% | $55,866 to $70,606 | $111,732 to $141,212 | $81,364 to $96,107 |

| 9.3% | $70,606 to $360,659 | $141,212 to $721,318 | $96,107 to $490,493 |

| 10.3% | $360,659 to $432,787 | $721,318 to $865,574 | $490,493 to $588,593 |

| 11.3% | $432,787 to $721,314 | $865,574 to $1,442,628 | $588,593 to $980,987 |

| 12.3% | $721,314+ | $1,442,628+ | $980,987+ |

These updated tax brackets reflect California’s graduated tax system, where higher incomes face higher tax rates.

Is there a personal exemption or standard deduction in California?

Yes, California offers both a personal exemption and a standard deduction. If you are a single filer, your standard deduction is $5,540. For married couples filing jointly or heads of household, it is $11,080.

You also get a personal exemption credit of $149 if you file as single, separate, or head of household. For joint filers and surviving spouses, the exemption is $298. If you have dependents, you can claim a $461 exemption.

Additionally, if you rent, you may qualify for a renter’s credit. Single filers earning $52,421 or less and joint filers earning $104,842 or less can claim this credit. California also has an earned income tax credit worth up to $3,644 for those earning up to $30,950.

Who has to file California state taxes?

You must file California state taxes if you meet certain conditions. If you are a resident, part-year resident, or nonresident earning income in California, you need to file a tax return. You also must file if you meet federal tax filing requirements or earn income above a specific amount.

Even if you live outside California, you still need to file if you earn money from a source in the state. Part-year residents must report all income earned while living in California. Nonresidents only report income earned from California sources.

Always check the latest income thresholds to know if you must file. Filing on time helps you avoid penalties and ensures you follow California tax laws.

Other things to know about California taxes

- Property Taxes

California’s property taxes are collected by counties, with assessors evaluating property values each year. The state’s average property tax rate is 0.68 percent, making it lower than the national average. - Disaster Relief

If your property is damaged by a natural disaster, like the January 2025 wildfires, you may qualify for a tax reassessment. However, you must file a claim within one year of the damage. - Estate and Corporate Taxes

California does not have an estate or inheritance tax. However, businesses face a corporate tax rate of 8.84 percent or $800, whichever amount is greater. - Other Taxes

The cigarette tax is $2.87 per pack, and there’s a 15 percent tax on both medical and recreational cannabis sales.

FAQs

How to calculate income tax in California?

To calculate California income tax, find your taxable income by subtracting deductions from your adjusted gross income. Apply the state’s graduated tax rates to each portion of your income.

How much income tax do I pay in California?

The tax you pay depends on your income and filing status. California’s income tax rates range from 1% to 12.3%, with an extra 1% for high earners making over $1 million.

How do I calculate California income tax?

First, determine your taxable income. Then, apply California’s tax brackets to each portion of your income. Finally, add any payroll taxes and other state-specific taxes.

How to calculate California state income tax for a married couple?

For married couples, combine your gross incomes. Then, subtract the married filing jointly standard deduction of $11,080. Apply the married tax brackets to find your total tax.

Does California have local income tax?

No, California does not have local income tax. You only pay state and federal taxes, though some cities may impose other local fees.

How much tax do I owe if I earn $34,000 in California?

If you earn $34,000 as a single filer, your tax falls within the 6% bracket. After deductions, your estimated tax is around $900 to $1,200, depending on your filing status.

Conclusion

Understanding California income tax is important for managing your finances. You need to know how to calculate your taxable income and apply the correct tax rates. Whether you are a single filer or married, your income level decides your tax rate. By knowing the deductions and credits available, you can lower the tax you owe.

California does not have a local income tax, which simplifies things. If you earn a specific amount, you can estimate how much you will pay. Using the correct filing status helps you avoid overpaying or underpaying your taxes.

It is helpful to stay updated on tax changes each year. Knowing the current tax brackets and deductions allows you to plan better. If you are unsure, using a tax calculator or consulting a professional can help. By understanding these basics, you can stay on top of your tax responsibilities and avoid surprises.