The NJ Sales Tax Calculator helps you quickly find the sales tax for any purchase in New Jersey. Just enter the purchase price and the ZIP code, and you’ll see the exact tax amount. This tool is fast, free, and easy to use. Whether you’re shopping in person or online, you can get the correct tax rate instantly.

In this article, we explain how to calculate NJ sales tax manually and how to use this calculator. You’ll also learn about tax-exempt items in New Jersey. If you want to explore more, check out our general sales tax calculator.

If you’re curious about federal income tax, try our tax bracket calculator for detailed insights. This tool is perfect for anyone who wants to understand and calculate taxes without the hassle. Use the NJ Sales Tax Calculator today to make sure you pay the right amount every time.

What is the sales tax rate in New Jersey?

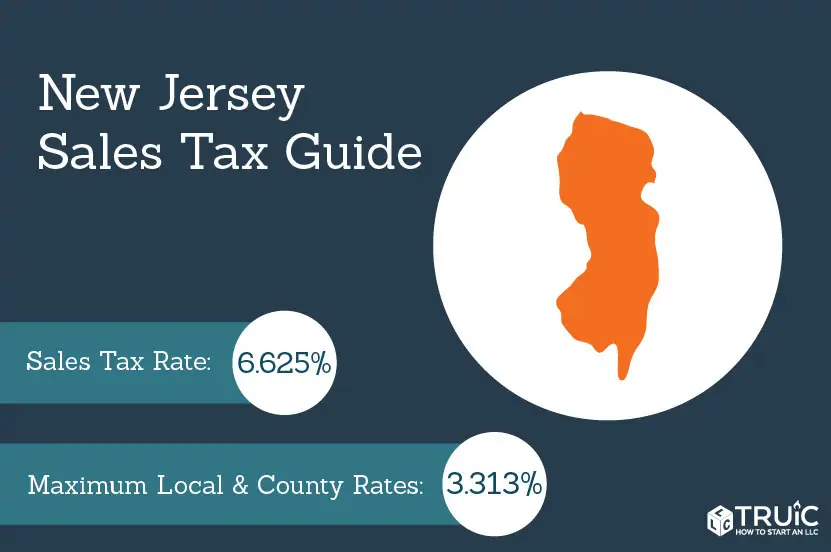

In New Jersey, you only pay sales tax at the state level. The current sales tax rate is 6.625%. This rate applies to most goods and services you buy. However, in Millville, there is an extra 2% special sales tax.

This means you pay a slightly higher rate there. Unlike other states, New Jersey does not have county or city sales taxes. Knowing these rates helps you calculate the correct tax amount.

Use our NJ Sales Tax Calculator to get quick and accurate tax estimates for any purchase in the state.

How do I use this Sales Tax Calculator New Jersey?

Using our NJ Sales Tax Calculator is simple and quick. Just follow these easy steps to get accurate sales tax estimates in seconds.

- Enter the Purchase Amount

Input the total cost of the item or service you purchased. - Provide the ZIP Code

Add the ZIP Code for the location where the purchase occurred. - View Instant Results

The calculator will display the exact sales tax amount immediately.

For example, if you buy a car for $16,000 in ZIP Code 7305, the total sales tax will be $1,060.00. This tool works for any purchase in New Jersey, ensuring you get the right tax calculation every time. Whether it’s a small item or a big purchase, the calculator makes it easy and fast.

How do I calculate sales tax in New Jersey?

You can calculate New Jersey sales tax easily by following these steps:

- Find the purchase amount – Include the shipping cost if needed.

- Know the tax rate – The state sales tax in New Jersey is 6.625%.

- Check for special taxes – Some areas may charge extra.

- Do the math – Multiply the purchase amount by the total tax rate.

For example, if you buy something for $1,000, the sales tax will be $66.25. Always check for special rates in your area for accurate results.

How 2025 Sales Tax are calculated in New Jersey

In 2025, the New Jersey sales tax rate remains 6.625%. There are no county or city taxes in the state. However, some areas may charge a special rate between 0% and 2%.

To calculate your sales tax, multiply your purchase amount by the applicable rate. For example, if you buy an item for $500, the sales tax will be $33.13.

Always check if special rates apply in your area to get an accurate calculation. This ensures you know the total cost before making any purchase in New Jersey.

New Jersey state rate(s) for 2025

Understanding New Jersey’s sales tax is crucial for accurate budgeting. In 2025, the state applies different rates based on location. Here’s a quick breakdown to keep you informed:

- Lowest Tax Rate – 6.625%

This is the minimum sales tax in areas like Avenel, New Jersey. Most cities follow this base rate. - Other Common Rates – 7%

Certain regions apply a slightly higher rate, increasing the total tax you pay. Always check your area’s specific rate. - Highest Tax Rate – 8.625%

Millville has the highest rate due to a special surcharge. This can significantly affect large purchases. - Average Combined Rate – 6.643%

Across New Jersey, the average tax rate falls slightly above the base rate.

Always verify your local rate to avoid surprises when making purchases.

FAQs

What items are exempt from sales tax in New Jersey?

Certain items are exempt from sales tax in New Jersey. This includes unprepared food, clothing, prescription drugs, and medical devices. Always check the latest list for updates.

Does New Jersey have sales tax?

Yes, New Jersey has a statewide sales tax of 6.625%. Some areas, like Millville, impose a special rate, increasing the total tax to 8.625%.

How much is sales tax in New Jersey on a $1,000 purchase?

On a $1,000 purchase, the standard sales tax in New Jersey is $66.25 (6.625%). If a special rate applies, the tax could be higher.

How do I calculate NJ sales tax?

To calculate NJ sales tax, multiply the purchase price by 6.625% (or the applicable rate). For example, a $500 item will have $33.13 in sales tax.

Is sales tax 7% in NJ?

No, the current general sales tax rate in New Jersey is 6.625%. However, some areas may have a special rate that increases it to 7% or higher.

Is sales tax more in NJ or NY?

New Jersey’s base sales tax is 6.625%, while New York’s is 4%. However, with local surcharges, New York’s total can exceed New Jersey’s in some areas.

How to collect NJ sales tax?

To collect NJ sales tax, you must register with the New Jersey Division of Taxation. Then, add the correct tax rate to your sales and submit it regularly.

How to calculate sales value?

To calculate sales value, subtract any discounts from the original price. For tax-inclusive prices, divide the total by 1 + tax rate to find the base.

How to compute percentage tax?

To compute percentage tax, multiply the total amount by the tax rate (expressed as a decimal). For example, $200 at 6.625% equals $13.25 in tax.

Conclusion

In New Jersey, understanding sales tax is important for you. The state rate is 6.625%, but some areas have special rates. You should always check the latest rates before making a purchase.

If you are a business, you must collect and report sales tax. Use a reliable calculator to find the correct amount quickly. This will save you time and help you avoid mistakes. Always include the tax in your final price to stay compliant. Knowing the tax rules can help you plan better and manage costs.

Whether you are buying or selling, understanding sales tax is essential. With the right tools, you can handle it easily and accurately.